Photo Source: www.realtytrac.com

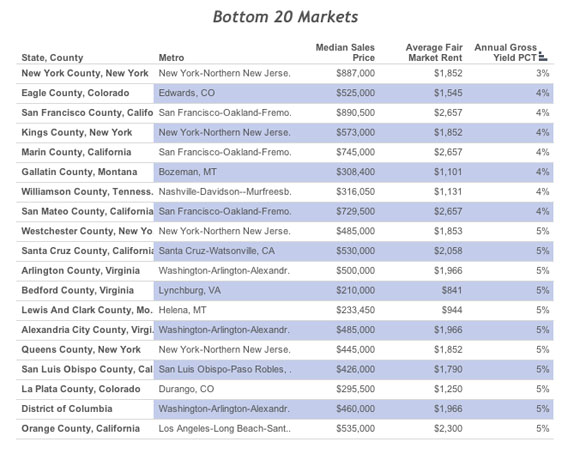

New York City is on top of another real estate list, no surprise. The list of top 20 worst counties in America to be a landlord, surprise!

Manhattan, although being the priciest borough of the five, has the lowest percentage of cash-flowing rental returns. Cash-flow rental property gives the landlord wealth in the long-term, through the appreciation of the property. During the time of appreciation the landlord is also obtaining monthly income via rent.

In order to successfully secure income from monthly rentals in surplus the landlord would have to be making a significant percentage of the original sales price per year. Take Wayne County, Michigan for example, which tops the list of Top 20 Markets for Landlords. The median sales price is $44,900 and the average fair market rent is $1,124 giving a 30% Annual Gross Yield Percentage.

New York City however, is a different ball game entirely. The market prices in NYC differ greatly from areas like Wayne County. Looking at the list you can see that in Manhattan the median sales price is $887,000 with an Average Fair Market Rent of $1,852. Now, it must be taken into consideration how skewed these figures can be.

Manhattan is a place where a condominium can sell for up to $70 million dollar or where places like the Wildenstein townhouse can sell for $100 Million dollars. These types of purchases aptly send the median sales price to a new level that is not representative of all the homes on the market. With the ultra-luxurious sale listings on the island of Manhattan, the prices displayed are not always completely truthful of the NYC market as a whole.

Manhattan and the rest of NYC alike, is also currently experiencing a serious inventory shortage. Property in Manhattan is highly in demand, however the amount of places on the actual market are not even close to representative of the amount of buyers that are looking. With that in mind, prices are driven up substantially as bidding wars are a common trend.

A second item to keep in mind when thinking about New York being an atrocious destination for landlords is the methodology of calculating the Annual Gross Yield percentage. The calculation is equated by taking the 2014 fair market rent for a three-bedroom home and multiplying it by 12 months, and then dividing the product by the median sales price of residential properties in each county. Three-bedroom apartments and the price they fetch, are also not an accurate representative of total market listings and property types.

A tertiary concern when thinking about being a landlord in New York City is the length of time the property has been owned, as these figures are representative of the current market conditions within certain parameters. If a landlord has been sitting on a property for years, chances are that he is certainly making increased rental revenue, as property value in New York City is always increasing. The value of these properties are always on the up and up. New York City was one of the few places in the U.S. that did not suffer price decrease during the 2008 recession. Prices here were steady throughout the recession, a cause of this could be due to mainly due to the severe shortage of inventory as previously mentioned.

NYC is constricted to a finite amount of space. Only wielding the power to build upwards but never outwards. Overall, is NYC expensive? Yes. Should landlords shy away from NYC based on these numbers? No. These numbers are extremely subjective and refined to only talking about only a portion of the market here in NYC.