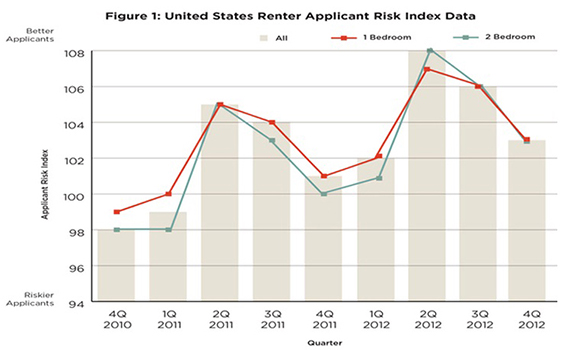

It seems New Yorkers are on the right track. Back in 2010, the risk of default for renters applying for apartments was at a mundane 98 for 2 bedroom apartments, and close to 99 for 1 bedroom apartments. Being as numbers below 100 increases the risk of default for applicants, New Yorkers were in a position - financially - of having property managers more readily deny their applications. According to CoreLogic, in a short two year period this risk of default has dramatically changed.

A report of the nation’s Renter Application Risk Index is generated quarterly by CoreLogic. This quarter, we’re shown that the risk index has decreased from 101 in 2010 to 103 in 2012. Of this decrease, the most abrupt change occurred in Manhattan. In the fourth quarter of 2012, New Yorkers produced a risk of default of 124, while back in the same quarter of 2011, we see that the risk of default was counted at 120. In a single year, risk decreased for city dwellers and property managers alike.

Being as the risk of default has shot over the 100 barrier, it seems that renters in New York have found themselves in a fit of financial security since the report asses the quality of credit. Property managers are finding themselves more willingly accepting applications for both one bedroom and two bedroom dwellings. There’s been a substantial growth in those who are well-financed, which should subsequently increase the amount of those looking to rent out luxury apartments within the city.